Standard Chartered Credit Card Funds Transfer

Standard Chartered offers a fast approval for funds transfer and savings of up to $1950 and they also offer flexible payment terms. Very ideal for those who want to reduce interest charges on your other outstanding balances with other banks using this Standard Chartered Credit Card Funds Transfer.

Standard Chartered Bank Singapore

Standard Chartered Bank in Singapore is an integral part of an international Banking group as it is where the bank opened its first branch in 1859. After about 150 years, the bank is still adherent to its purpose which was to drive commerce and prosperity through its unique diversity. In October 1999, Standard Chartered Bank was amongst the first international banks to receive a Qualifying Full Bank (QFB) license which is an endorsement of the Group's long-standing commitment to its commitment in the business. The Bank has won numerous accolades in the financial sector including the Singapore Quality Class (SQC) certification and certification for Innovation and Service which represents its sustainable business performance and robust management system. Standard Chartered banking system is present in 60 markets having has 1,026 branches worldwide and employ more than 86,000 people around the world. It is also among the top 100 largest companies listed on the London Stock Exchange and also listed on two of Asia's largest stock exchanges.

Forums mentioning Standard Chartered Credit Card Funds Transfer

Are interest fees really free with Credit Card Funds Transfer by Standard Chartered Bank (Singapore) Limited?

Standard Chartered Credit Card Funds Transfer

Other products by Standard Chartered Bank Singapore

Standard Chartered Bank Singapore

Standard Chartered Unlimited Cashback Credit Card

Unlimited Cashback Credit Card allows high spenders to conveniently maximize earnings and enjoy great transit benefits. By using this card, you are accessing a no cashback cap and no minimum spend. By using this card. If you ever use this card, you'll earn unlimited 1.5% flat cash back with no minimum required spend.

Standard Chartered Bank Singapore

Standard Chartered Rewards+ Credit Card

Rewards+ Credit Card is high-quality for shoppers with a specialized predominant card–such as a shopping card–who would like to maximize rewards for dining and overseas expenses, beyond the base fee provided with the primary card.

Standard Chartered Bank Singapore

Standard Chartered VISA Infinite

Visa Infinite Credit Card is great for business travelers looking to maximize miles and enjoy easy convenience during trips abroad should consider Standard Chartered Visa Infinite Card. Most travel cards don’t require a minimum spend to access higher rates, SC Visa Infinite Card is fit to consumers who spend closer to S$6,000+ per month.

Standard Chartered Bank Singapore

Standard Chartered Spree Credit Card

The Spree Credit Card provides you unresistible privileges It covers the features of SC Easybill, Credit Card Credit Limit Review, Temporary Credit Limit Increase, Fund Transfer, EasyPay, Credit Card Payments, 0% Interest Installment Plan, Live The Good Life every day, Mobile Payments, Tap-and-Pay Payments, and Card Safe Guarantee.

Standard Chartered Bank Singapore

Standard Chartered Prudential Platinum Card

Prudential Platinum Card can reduce the cost of your monthly insurance premiums. With Prudential Platinum Card you Offset Your Premiums. You can pay insurance premiums with your points. This card only lets you earn 1 point for every $1 you spend.

Standard Chartered Bank Singapore

Standard Chartered VISA Platinum

Standard Chartered offers a Platinum Visa/Mastercard Credit Card which entails card offers and privileges at over 3,000 outlets in Asia and at the same time lets you earn Rewards Points on everything you spend.

Standard Chartered Bank Singapore

Standard Chartered PruPrestige VISA Signature Card

The PruPrestige Visa Signature Card lets you earn rewards points fast on your spending, and you can use them to offset your Prudential insurance premiums. PruPrestige Visa Signature Card features offers SC EasyBill, Credit Card Credit Limit Review, Temporary Credit Limit Increase, Fund Transfers, and EasyPay.

Standard Chartered Bank Singapore

Standard Chartered NUS Alumni Platinum Card

Standard Chartered created a credit card that gives you freedom and allows you to contribute to your Alma Mater -- the NUS Alumni Platinum Card is not only just an Alumni Card, it is also a credit card that is packed with reward points and along with all other benefits you can get off of Standard Chartered's wide range of deals and offers.

Standard Chartered Bank Singapore

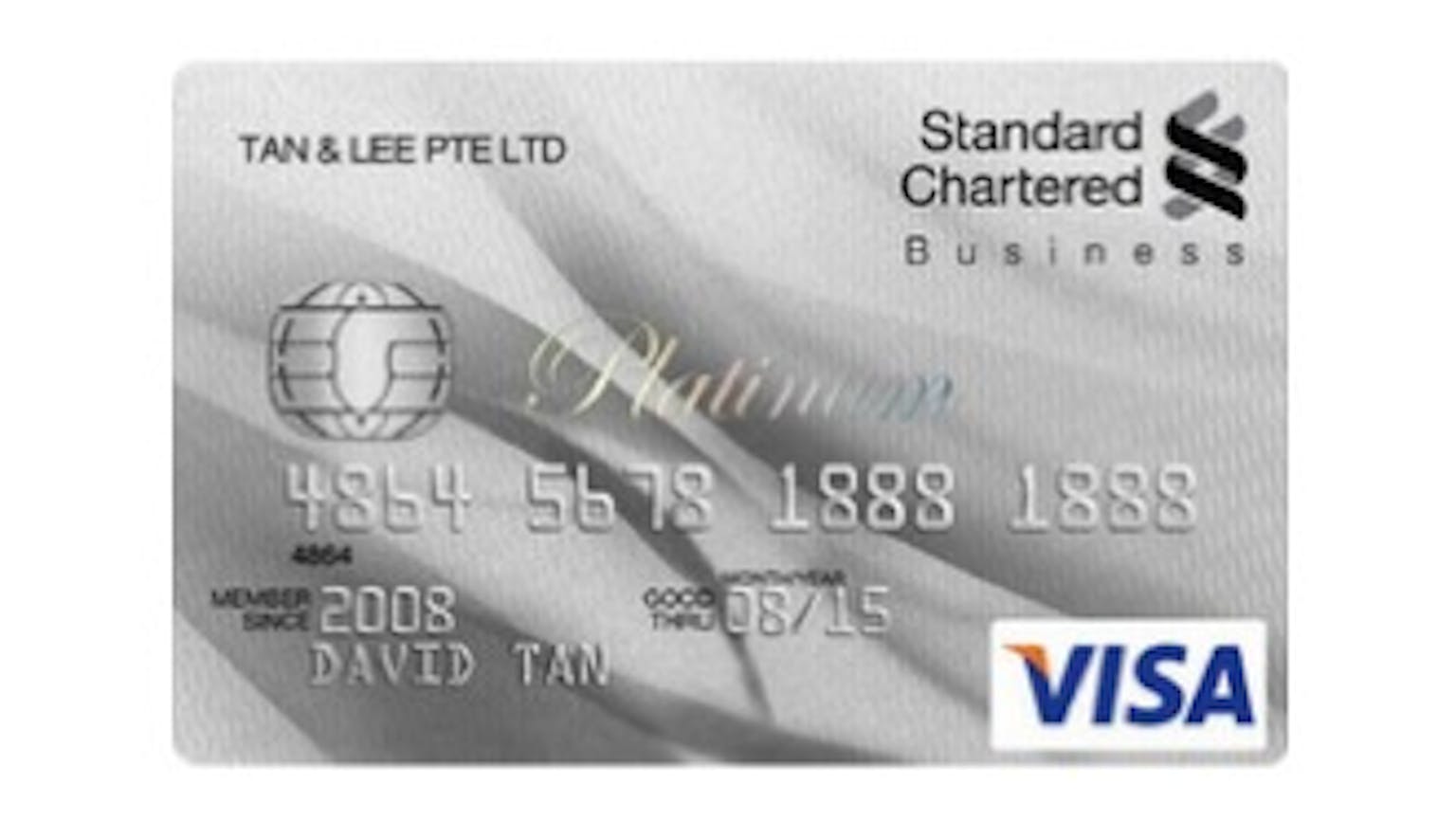

Standard Chartered Business Platinum Card

Business Platinum Card offers a great 0% interest financing option. This card provides a 36 months 0% interest instalment plan. It offers the benefits of SC EasyBill, Credit Card Credit Limit Review, Temporary Credit Limit Increase, Fund Transfers, and EasyPay, Credit Card Payments, 0% Interest Installment Plan, Live The Good Life every day, Mobile Payments, Tap-and-Pay Payments, and Card Safe Guarantee.

Primarily when you apply for a Credit Card Funds Transfer you should get cash disbursed in 15 minutes into your eligible designated account. That said please note that the 0% interest rate is valid for a Credit Card Funds Transfer with a 3, 6, 9 or 12 month tenure and is only applicable to the amount transferred pursuant to the application submitted in respect of the promotion. The prevailing interest rate of 26.9% p.a. applies after the expiration of the tenure indicated in the application form. You can read up more at the Credit Card Funds Transfer Programme Terms and Conditions apply.